Paying tax by credit or debit card

HMRC has not accepted personal credit card payments since January 2018 when credit card surcharges on personal credit cards were banned.

However, HMRC continues to accept payments by corporate credit

Scottish government announces new childcare initiatives

Scotland’s new First Minister Humza Yousaf has announced a new £15 million investment to help tackle child poverty. This investment will see thousands more low-income families benefit from free school

Bank of England and HMRC increase interest rates

The Bank of England’s Monetary Policy Committee (MPC) met on 22 March 2023 and voted 7-2 in favour of raising interest rates by 25 basis points to 4.25% in a move to tackle continued, rising

Spring Finance Bill published

The government published the Spring Finance Bill 2023 on 23 March 2023. The Bill is officially known as the Finance (No 2) Bill, because it is the second Finance Bill of the 2022-23 Parliamentary

Scottish Parliament approves 3% rent cap

The Scottish Parliament has approved a new 3% rent cap for most private renters that will come into effect from 1 April 2023 for an initial six-month period with the option to extend for another

Spring Budget 2023 – Energy Price Guarantee

The Chancellor had previously announced that the energy price guarantee cap, which will see the average household have their energy bills capped at £2,500 a year, would remain in place until the 31

Scottish Winter Payments Support

The Scottish Winter Heating Payment is a new Scottish Government benefit that replaces the Department for Work and Pensions’ (DWP) Cold Weather Payment. It can be claimed by eligible claimants on low

Bereavement Support Payment

The amount of Bereavement Support Payment you can claim will depend on your relationship to the person who died and when you make your claim.

Your payments will be paid into your bank, building

The digital pound

A new consultation has been published jointly by HM Treasury and the Bank of England to consider the launch of a potential digital pound, or central bank digital currency (CBDC). The possible new

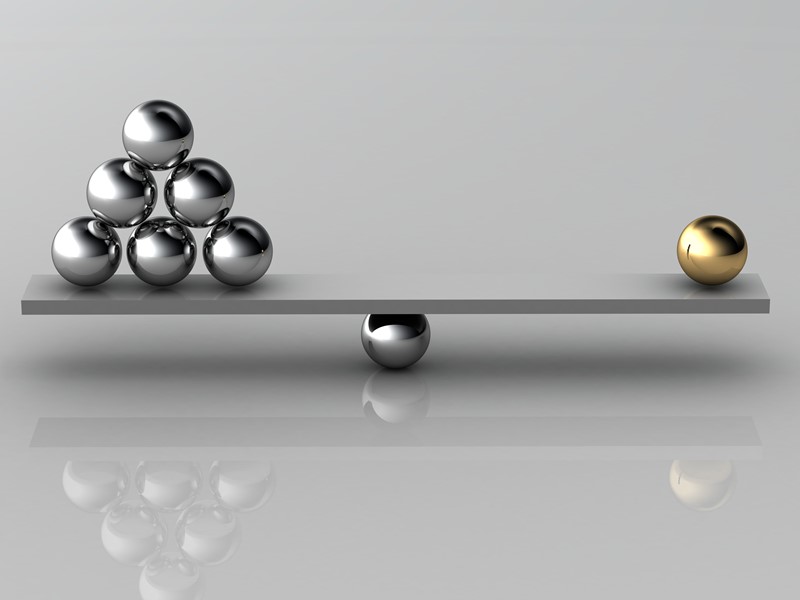

Balancing your budget

Homeowners and landlords will have seen a significant increase in their mortgage payments due to the rise in the Bank of England Base rate over the past 6-months if any fixed rate agreements have