Homeowners and landlords will have seen a significant increase in their mortgage payments due to the rise in the Bank of England Base rate over the past 6-months if any fixed rate agreements have expired in this period or if you have a variable rate arrangement.

And mortgage payers who are nearing the end of their fixed deals will likewise see a significant rise in their monthly payments as lenders’ variable rates are currently as high as 7%.

If your variable loan repayments have increased, a visit to your mortgage broker may pay dividends if they can place your loan with a lower interest, fixed rate deal.

A reminder for buy-to-let non-corporate borrowers

Mortgage interest is not allowed as a deduction against your rental income. Income Tax relief is limited to a 20% tax credit (20% of qualifying mortgage interest).

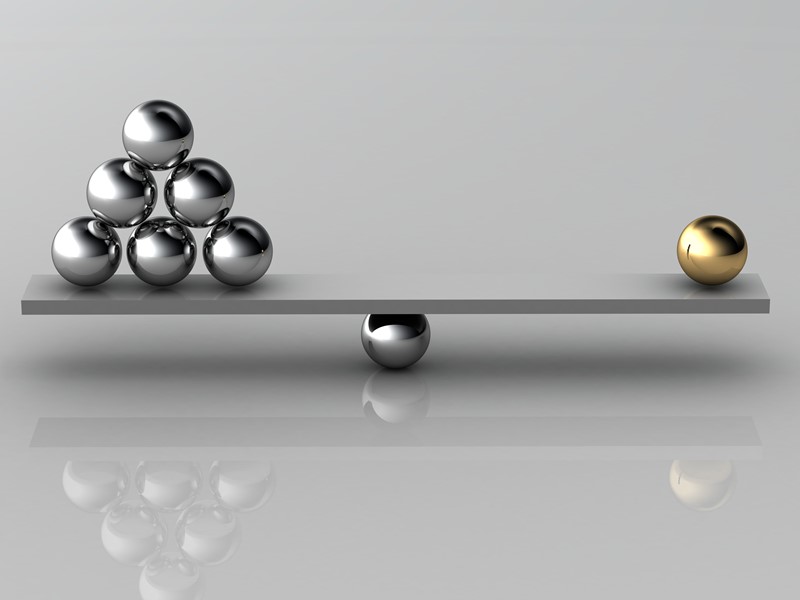

Consequently, taxpayers whose rental profits are taxed at higher Income Tax rates could be paying Income Tax at 40% or 45% and only receiving tax relief on their mortgage interest at 20%.

Regional differences in Income Tax rates may apply in Scotland.