IHT change of domicile

It is possible in certain circumstances for an individual to have two domiciles although this is unusual. There is a concept in the UK of deemed domicile, whereby any person who has been resident in

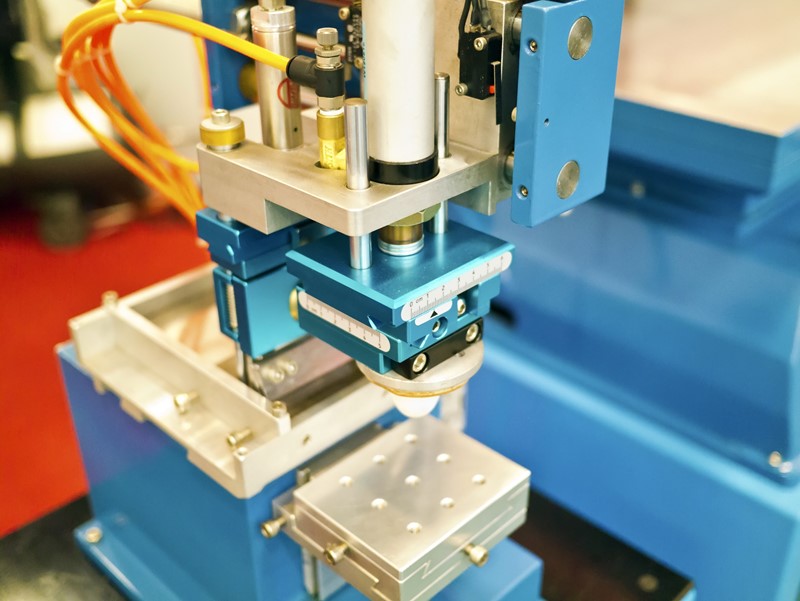

Décor and plant and machinery allowances

Capital Allowances are the deductions which allow businesses to secure tax relief for certain capital expenditure. Capital Allowances are available to sole traders, self-employed persons or

Further change to SEISS 5 legislation

HM Treasury has published a Correction Treasury Direction made under the Coronavirus Act 2020, section 76, which modifies and extends the effect of the Self-Employment Income Support Scheme (SEISS).

When is a company dormant for tax purposes?

If a company has stopped trading and has no other income then the company is usually classed as dormant for Corporation Tax purposes.

A company is usually dormant for Corporation Tax if it:

has

VAT inclusive and exclusive prices

When identifying the amount of VAT charged, it is important to distinguish between VAT inclusive and VAT exclusive prices. A VAT inclusive price includes VAT at the prevailing rate.

When a VAT

Pub secures reduced tied rent and discounts

The Pubs Code Adjudicator is responsible for enforcing the statutory Pubs Code. The Pubs Code regulates the relationship between all pub companies owning 500 or more tied pubs in England and Wales and